Post Date : 13

Feb || Created By : LocumNest

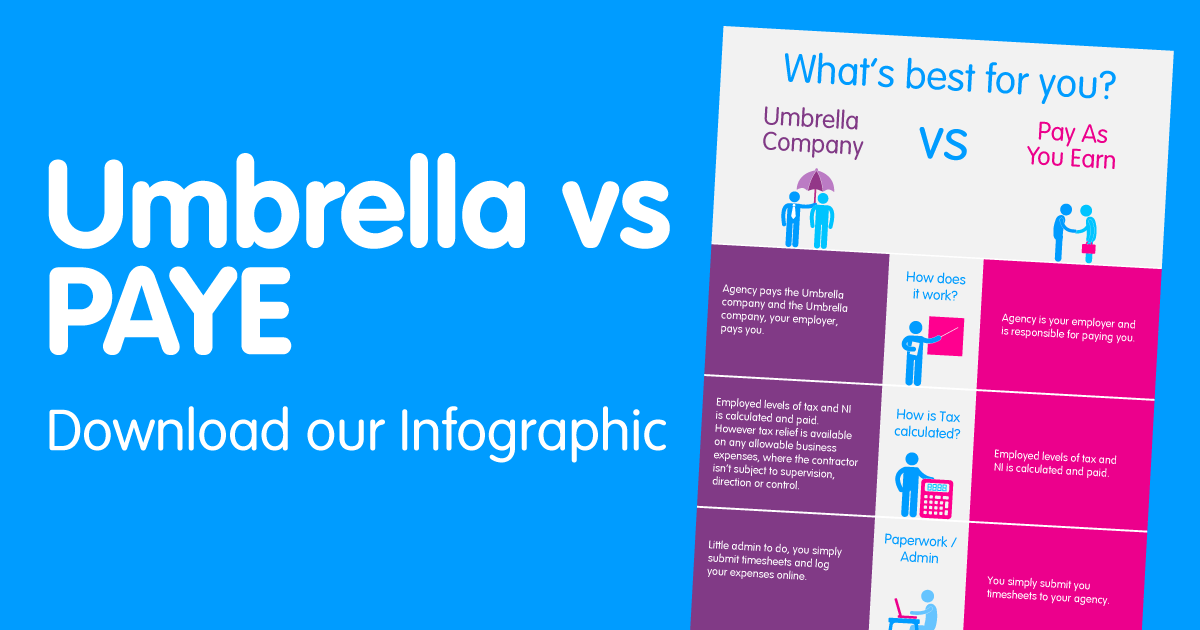

Understanding The Key Differences: Umbrella Company Vs Agency PAYE

1. Umbrella Company Vs Agency PAYE

When it comes to managing payroll for contractors and freelancers, there are two main options to consider: umbrella companies and agency PAYE. While both options handle the practicalities of payroll, there are important differences between the two. Understanding these differences is crucial for employers and workers alike to ensure compliance with HMRC and IR35 regulations. In this blog, we will explore the key distinctions between umbrella companies and agency PAYE, and why Smashpay is the trusted umbrella payroll services provider in the UK. Whether you are an employer or a worker, this article will help you make an informed decision when it comes to choosing a payroll services provider.

2. What is an Umbrella Company?

An umbrella company is a third-party organization that acts as an intermediary between contractors/freelancers and their clients. It operates as the employer for the contractor, handling all aspects of payroll, taxes, and administrative tasks. When a contractor is engaged with an umbrella company, they become an employee of the umbrella company, and the client pays the umbrella company for their services.

Umbrella companies offer a hassle-free solution for contractors who prefer not to operate as self-employed or set up their own limited company. They provide a range of services, including processing timesheets, invoicing clients, deducting taxes and National Insurance contributions, and ensuring compliance with relevant legislation.

By working with an umbrella company like Smashpay, contractors can benefit from expert guidance, reliable support, and peace of mind knowing that their payroll responsibilities are taken care of efficiently and accurately.

3. What is Agency PAYE?

Agency PAYE, also known as Agency Worker PAYE, is another option available for contractors and freelancers. In this arrangement, contractors are employed directly by an agency, which then places them on assignments with clients. The agency handles the payroll, tax deductions, and administrative tasks for the contractor.

Unlike working with an umbrella company, where contractors become employees of the umbrella company, Agency PAYE involves being an employee of the agency. The client pays the agency for the contractor's services, and the agency then pays the contractor their salary or wages.

Agency PAYE offers a similar level of convenience as umbrella companies, as the administrative burden is taken care of by the agency. However, contractors might have less control over their finances and may not receive the same level of support and guidance as they would from an umbrella company.

It is important for contractors to carefully consider their individual circumstances and preferences when choosing between an umbrella company and Agency PAYE. Both options have their benefits and drawbacks, and it is crucial to make an informed decision based on one's specific needs.

4. Tax and National Insurance Contributions for Umbrella Company and Agency PAYE

One of the key factors that contractors should keep in mind when deciding between an umbrella company and Agency PAYE is the tax and National Insurance contributions they will be responsible for.

With an umbrella company, contractors are employed by the company and are therefore subject to PAYE (Pay As You Earn) tax and National Insurance (NI) contributions. The umbrella company calculates and deducts these taxes from the contractor's income before paying them their net salary. This means that contractors benefit from the convenience of having their taxes handled for them, ensuring compliance with HMRC regulations.

In contrast, with Agency PAYE, the agency takes care of the tax deductions and NI contributions on behalf of the contractor. The agency calculates and deducts these amounts from the payment received from the client, reducing the contractor's gross payment before paying them their salary or wages.

It's essential for contractors to understand the tax implications of both options and assess how they align with their financial goals and circumstances. It may be beneficial for some contractors to have their taxes taken care of by the umbrella company, while others may prefer the agency handling these responsibilities. Consulting with a financial advisor or an accountant can help contractors make an informed decision regarding their tax and NI contributions.

5. Benefits and drawbacks of using an Umbrella Company

Benefits and drawbacks of using an Umbrella Company Using an umbrella company has its fair share of advantages and disadvantages that contractors should consider when making a decision. Let's take a closer look at these aspects.

Benefits:

1. Convenience: One of the main benefits of using an umbrella company is the convenience it offers. Contractors don't have to worry about calculating and deducting taxes themselves; the umbrella company takes care of all the administrative tasks on their behalf. This frees up contractors' time, allowing them to focus on their work and other important aspects of their business.

2. Compliance and peace of mind: Umbrella companies are well-versed in tax regulations and ensure that contractors remain in compliance with HMRC rules. By using an established umbrella company, contractors can have peace of mind, knowing that their tax and NI contributions are being taken care of properly.

3. Access to employee benefits: Umbrella companies often provide contractors with the opportunity to access employee benefits such as holiday pay, sick leave, and pension schemes. This can be particularly advantageous for contractors who want to enjoy some of the perks typically associated with being an employee.

Drawbacks: 1. Costs: Using an umbrella company comes with a fee. Contractors should carefully consider these costs and assess whether the benefits outweigh the expenses. It's important to compare different umbrella companies and their fee structures to ensure contractors get the best value for their money.

2. Less control: While using an umbrella company offers convenience, some contractors may feel that they have less control over their finances. The umbrella company deducts taxes before paying the contractor, which means they don't have full access to their gross income. Contractors who prefer to manage their own finances and have more control over their cash flow may find this aspect restrictive.

3. Limited options for tax planning: Umbrella companies typically have a standard tax setup, and contractors may have limited options for tax planning and optimization. Contractors who have more complex financial situations or who prefer a more tailored approach to their taxes may find an umbrella company less suitable.

In the next section, we will explore the benefits and drawbacks of using Agency Payroll as an alternative to the umbrella company model. Stay tuned!

6. Benefits and drawbacks of using Agency PAYE

Benefits and drawbacks of using Agency PAYE Just like using an umbrella company, utilizing Agency PAYE also has its own set of advantages and disadvantages that contractors should consider.

Benefits:

1. Flexibility: One of the key benefits of using Agency PAYE is the flexibility it offers contractors. With this option, contractors have the freedom to work with multiple clients or agencies without being tied to a single umbrella company. This can provide contractors with more opportunities and the ability to diversify their income streams.

2. Higher take-home pay: Compared to using an umbrella company, contractors using Agency PAYE may have the potential for higher take-home pay. This is because Agency PAYE typically involves fewer administrative fees and overhead costs, allowing contractors to retain a larger portion of their income.

3. More control over finances: For contractors who prefer to have more control over their finances, using Agency PAYE may be a better fit. Contractors are responsible for managing their own taxes and have greater visibility and control over their cash flow. This can be advantageous for those who want to optimize their financial arrangements and take advantage of any tax planning opportunities.

Drawbacks:

1. Administrative burden: Unlike using an umbrella company, contractors using Agency PAYE are responsible for their own administrative tasks, including calculating and deducting taxes. This can add an extra layer of complexity and administrative burden to the contractor's workload.

2. Limited employee benefits: Unlike umbrella companies, Agency PAYE may not offer the same extent of employee benefits such as sick pay, holiday pay, and pension schemes. Contractors using this option may need to make their own arrangements for such benefits, which can be an additional cost or hassle.

3. Potential tax complications: Contractors using Agency PAYE may face more complexity when it comes to managing their taxes. They need to stay up to date with changing tax regulations and ensure that they are fully compliant with HMRC requirements. This can require more time and effort on the contractor's part.

In the next section, we will delve deeper into the comparison between the two models and help contractors make an informed decision based on their unique needs and circumstances. Stay tuned!

7. Conclusion

In conclusion, both umbrella companies and Agency PAYE have their own benefits and drawbacks. It is important for contractors to carefully consider their individual needs and circumstances before making a decision.

If flexibility and the ability to work with multiple clients or agencies are important, then using Agency PAYE may be a better choice. Contractors will have more control over their finances and potentially higher take-home pay.

However, contractors must also be prepared for the additional administrative burden they will face with Agency PAYE. They will be responsible for their own taxes and may not receive the same level of employee benefits.

On the other hand, umbrella companies provide a more streamlined and hassle-free experience. They handle all administrative tasks and provide comprehensive employee benefits. However, this convenience comes at a cost, as contractors may have less flexibility and potentially lower take-home pay.

Ultimately, the decision between an umbrella company and Agency PAYE should be based on the contractor's priorities and preferences. It is recommended that contractors seek professional advice and thoroughly evaluate their options before making a final decision.